Navigating the Transition to Payroll Software with Direct Deposit: a Guide for Small Businesses

Imagine you’re the owner of a thriving small business. You’ve just had your best quarter yet, but with growth comes complexity, especially in payroll management. You’re spending a significant amount of time calculating wages, deducting taxes, and manually distributing checks.

This is when you start considering the shift to payroll software with direct deposit. It sounds promising, but you’re unsure how to start the transition or what to expect. You’re not alone in this. Countless businesses have navigated this path before, and their experiences can serve as your guide.

But why should you make this switch and how will you navigate this transition smoothly? Let’s explore.

Key Takeaways

• Payroll software with direct deposit streamlines salary payment processes, automates calculations, and reduces errors.

• Choosing the right payroll software involves analyzing current inefficiencies, considering scalability, and evaluating direct deposit benefits.

• Budgeting for the transition includes estimating initial and ongoing costs, calculating potential savings, and setting aside a contingency budget.

• Training and managing the transition requires providing software overview, hands-on training, designating an in-house expert, and ensuring seamless integration.

Understanding Payroll Software

Let’s dive into understanding payroll software, a crucial tool that streamlines your company’s salary payment process. You’ve probably spent countless hours on manual calculations and paperwork. But with payroll software, you’ll say goodbye to these time-consuming tasks.

Think of payroll software as your personal assistant. It takes over the mundane tasks of calculating wages, withholding taxes, and ensuring timely payments to your employees. It’s not just about efficiency; it’s about accuracy too. Payroll errors can cause serious headaches for you and your employees, not to mention potential legal issues. This software minimizes these risks by automating calculations and keeping track of changing tax laws.

You’ll also appreciate how payroll software keeps everything in one place. No more hunting for paper records or trying to remember which employee took vacation time last month. It’s all there, in a user-friendly interface that makes payroll a breeze instead of a chore.

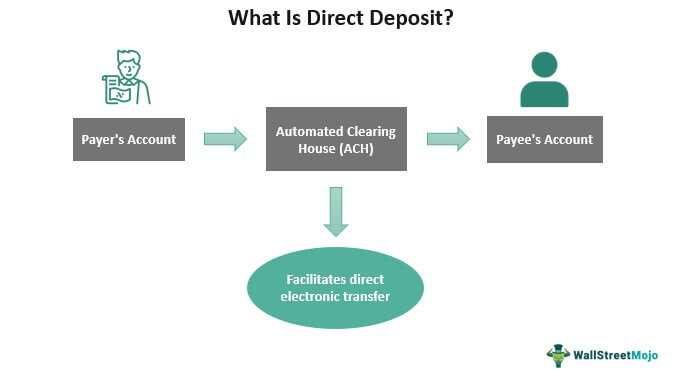

The Importance of Direct Deposit

As you streamline your payroll process, consider the pivotal role of direct deposit in enhancing efficiency and convenience for both your business and employees. Direct deposit reduces manual work, saving precious time that you can put to better use. It’s a digital solution that eliminates the physical process of writing, signing, and distributing checks.

Moreover, you’ll cut costs associated with paper checks, like printing and delivery expenses. Plus, direct deposit is more secure. There’s less risk of checks getting lost, stolen, or tampered with, which safeguards your business against potential fraud.

Direct deposit isn’t just beneficial for you, it’s a win for your employees too. They’ll appreciate the convenience of having their pay instantly available in their bank accounts without the need to cash a check. It’s reliable, with payments hitting their accounts like clockwork on payday.

Also, direct deposit supports the environment by reducing paper waste. It’s an easy way to make your business greener.

Analyzing Your Current System

Understanding the many benefits of direct deposit, it’s crucial to examine your current payroll system to identify areas that need improvement or changes. Start by identifying any inefficiencies or issues. Are you spending too much time on payroll? Are there errors in calculations? If you’ve answered ‘yes’ to these questions, it’s a clear sign that you need to upgrade to a more efficient system.

Consider the cost factor too. If you’re outsourcing your payroll, compare that cost with the cost of implementing a new payroll software. You might be surprised to find that transitioning to a software solution could be more cost-effective in the long run.

Next, evaluate your current system’s capabilities. Does it integrate with other systems you use? Is it scalable as your business grows? A system lacking these features can hinder your business’s growth and efficiency.

Lastly, think about your employees. A direct deposit system can provide them with quick and secure access to their earnings – a major plus in today’s digital age. Analyzing your current system is the first step to improving your payroll process and making a smooth transition to a payroll software with direct deposit.

Choosing the Right Software

With numerous options on the market, it’s crucial you pick the right payroll software that fits your business’s unique needs and budget. Don’t be swayed by flashy features you don’t need; focus on the essentials. The software you choose should be user-friendly, integrate seamlessly with your existing systems, offer direct deposit capabilities, and comply with regulatory requirements.

Payroll software varies greatly in price. Balance your budget constraints with the need for a reliable solution. Don’t skimp on critical functions, but also recognize that the most expensive option may not be the best fit for your business.

Consider the provider’s customer support. You’ll want reassurance they’ll be there when you need them, particularly during the transition period. Look for software that offers comprehensive training and support materials, so you and your team can get up to speed quickly.

Budgeting for the Transition

Before diving into the transition, it’s crucial you’ve set a realistic budget for the shift to payroll software with direct deposit capabilities. Understand that this change isn’t just about swapping out old systems for new ones—it’s an investment in your business’s future. It’s a move designed to streamline operations, save time, and ultimately, save money.

Here’s a simple four-step guide to help you budget for the transition:

1. Estimate Initial Costs: Determine how much you’ll need to spend on software acquisition, setup, and training. Don’t overlook the costs of data migration and potential downtime.

2. Consider Ongoing Costs: Think about monthly or annual software fees, updates, maintenance, and support services.

3. Calculate Potential Savings: Factor in time saved from automating payroll, reduced errors, and increased productivity. These savings can offset some of the costs.

4. Contingency Planning: Set aside a buffer for unexpected costs. It’s better to overestimate than to find yourself short.

Training Your Team

Once you’ve budgeted for the transition, it’s time to train your team on the new payroll software. Successful implementation hinges on your team’s ability to effectively use the software. Training shouldn’t be rushed or skipped. It’s critical to the process.

Start by providing an overview of the software’s functionalities. Explain how it’ll make payroll processes more efficient, and how direct deposit fits into the picture. It’s essential your team understands the benefits, not just the mechanics.

Next, dive into hands-on training. It’s best to use real scenarios to illustrate the process. Walk them through every feature, from setting up employee accounts to scheduling payments. Encourage questions and be patient with their learning curve.

Don’t forget about continuous training. Software updates are common, and your team should be prepared to adapt. Make it a point to schedule regular training sessions to keep everyone up-to-date.

Lastly, designate an in-house expert. This person should be well-versed in the software and can serve as a first point of contact for any questions or issues. Remember, your team’s ability to use the software effectively directly impacts payroll efficiency.

Managing Payroll Software Integration

As you delve into managing payroll software integration, it’s crucial you understand the steps involved for a smooth transition. This process might seem daunting, but with a systematic approach, you can navigate it successfully.

1. Understanding Your Current Processes: Before you can move forward, it’s important to fully understand your existing payroll processes. This will help you identify the necessary features in your new software, ensuring seamless integration with your current operations.

2. Data Migration: Transferring your data from your current system to the new one is a crucial step. It’s vital you double-check all entries for accuracy and completeness.

3. System Testing: Before going live, ensure all functionalities work as intended by conducting rigorous testing. This step can prevent any unexpected surprises during the actual implementation.

4. Training and Support: Once the system is up and running, it’s essential your team knows how to use it effectively. Consider arranging training sessions and ensure ongoing support is available.

Ensuring Compliance With Laws

After setting up your new payroll software, it’s crucial you ensure it complies with all relevant laws and regulations. Compliance isn’t just about avoiding fines and penalties. It’s about maintaining your business’s reputation and trust with your employees and stakeholders.

Being compliant means staying abreast of federal, state, and local payroll tax laws. You must ensure that you’re withholding the correct amounts from employee paychecks and remitting these funds to the appropriate tax agencies on time. You’re also responsible for reporting wages and taxes accurately in your business’s tax filings.

Don’t forget about wage and hour laws either. You’ll need to keep accurate records of employees’ hours worked, overtime, and breaks to avoid wage theft allegations.

Also, consider privacy laws. Your payroll software will handle sensitive employee data. You must ensure it’s secure and only accessible to authorized personnel.

If you’re uncertain about any of these aspects, don’t hesitate to seek legal advice. Compliance can be complex, but it’s a necessary part of running a business. With diligence and the right software, you can tackle this task confidently and maintain your business’s integrity.

Troubleshooting Common Issues

In your journey of transitioning to payroll software, you might encounter a few bumps along the road, but don’t fret – troubleshooting common issues is easier than you might think. With a bit of patience and the right knowledge, you can overcome these challenges efficiently.

Here are four common issues you might face and their solutions:

1. Incorrect Employee Information: Always ensure the accuracy of employee data. Mistakes in banking info or tax details can cause payment delays or compliance issues. Review and update records regularly.

2. Software Compatibility: Ensure your software is compatible with your current operating system and other business software. Compatibility issues can slow down or halt payroll processing.

3. Tax Calculation Errors: Incorrect tax calculations can lead to penalties. Regularly check for software updates to ensure that current tax rates and regulations are being used.

4. Security Concerns: Protect sensitive employee data by using software with robust security features. Regularly update passwords and limit access to key staff.

Evaluating the Software’s Performance

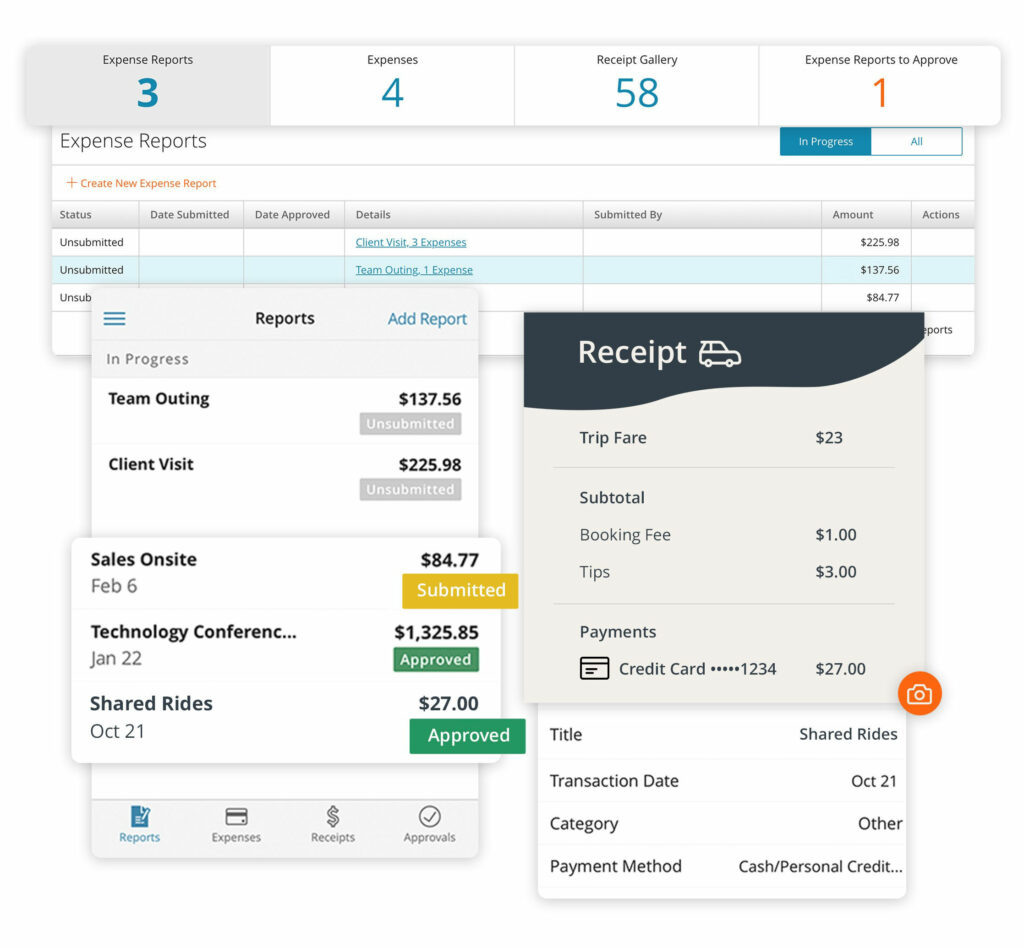

Once you’ve got your payroll software up and running, it’s crucial to regularly evaluate its performance to ensure it’s meeting your small business’s needs effectively. Don’t let the allure of automation make you complacent. Stay vigilant to ensure the software’s efficiency and accuracy.

Start by assessing the software’s ability to handle your payroll volume. Is it processing your employees’ pay without errors or delays? If it’s stumbling over basic functions, it might be time to reconsider your choice.

Next, consider the software’s direct deposit feature. It should be able to swiftly and securely transfer payments to your employees’ accounts. If it’s causing more headaches than it’s solving, you need to address these issues promptly.

The software should also be user-friendly. If you’re spending more time figuring out how to operate the system than you’re on actual business tasks, it’s not performing its job well.

Lastly, evaluate the software’s scalability. As your business grows, your payroll needs will change. A good software should be able to adapt to these changes without causing disruptions.

Conclusion

Transitioning to payroll software with direct deposit isn’t just about making things easier for your business. It’s about keeping up with the times, staying compliant, and ensuring your employees get paid on time.

Remember, choose your software wisely, budget for the transition, and always be ready for potential hiccups.

Evaluate the software’s performance regularly, and you’ll soon wonder how you ever managed without it.

It’s a big step, but one worth taking.