https://finanzasdomesticas.com/china-prohibe-las-criptomonedas/ – More to Know!

China has banned cryptocurrencies like Bitcoin to protect its financial system. The government is concerned about risks like money laundering and financial instability.

China has banned cryptocurrencies like Bitcoin to protect its financial system, making it harder for people to trade or use digital currencies. The government is focusing on its own digital currency instead.

Explore why China banned cryptocurrencies like Bitcoin.

What is https://finanzasdomesticas.com/china-prohibe-las-criptomonedas/?

The https://finanzasdomesticas.com/china-prohibe-las-criptomonedas/ discusses China’s ban on cryptocurrencies like Bitcoin, which was implemented to maintain control over the financial system and curb risks like fraud, money laundering, and economic instability.

China does not recognize cryptocurrencies as legal tender, and the government has introduced strict regulations to prevent financial institutions from offering services related to digital currencies.

Additionally, China has launched its own digital currency to compete with decentralized cryptocurrencies. This move has significantly impacted the global cryptocurrency market.

China’s Cryptocurrency Policies – What You Need to Know!

China has taken a firm stance against cryptocurrencies, viewing them as a threat to its financial stability. The government does not recognize cryptocurrencies like Bitcoin as legal tender, and the Chinese banking system does not accept or support transactions involving them.

This stance has led to strict regulations and prohibitions on cryptocurrency trading, mining, and related financial services.

The government has also introduced its own digital currency, aiming to maintain control over the financial system while competing with decentralized cryptocurrencies.

China’s Official Digital Currency – Discover it!

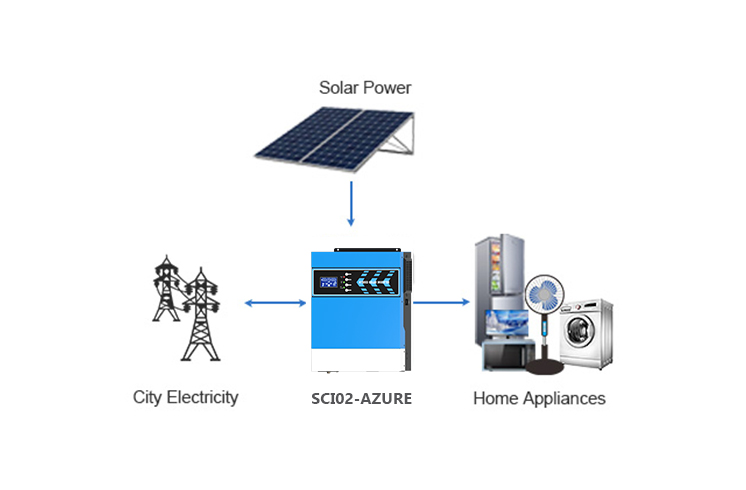

China’s digital money is called the Digital Currency Electronic Payment (DCEP) or digital yuan. It’s made and controlled by China’s central bank, the People’s Bank of China. Unlike Bitcoin, which is not controlled by any government, the digital yuan is managed by the Chinese government.

The main idea behind the digital yuan is to make payments easier and safer while keeping government control. People can use it to buy things just like regular money, but it’s all digital.

China wants this digital money to improve its financial system, reduce the use of cash, and make payments smoother. It also helps fight financial crime and makes the monetary system work better.

China’s Government-Backed Digital Currency – Market Value and Initiatives!

China has been actively developing and promoting its own government-backed digital currency, known as the Digital Currency Electronic Payment (DCEP) or digital yuan. This initiative aims to modernize the financial system, reduce the reliance on cash, and enhance the efficiency of transactions.

The digital yuan is designed to offer a secure and controlled alternative to cryptocurrencies like Bitcoin, which the Chinese government has banned due to concerns about financial stability and control.

As of now, the market value of China’s digital currency is steadily growing as it becomes more integrated into the daily transactions of businesses and individuals across the country.

The goal is to have a fully functional and widely used digital currency that complements the existing monetary system and supports China’s economic objectives.

Most Popular Cryptocurrencies in China – Explore!

In China, popular cryptocurrencies include Bitcoin, Ethereum, and Tether. Despite the country’s strict regulations on digital currencies, these cryptocurrencies still have a significant presence.

Bitcoin is widely recognized for its pioneering role in the crypto world and remains a top choice among Chinese investors. Ethereum, known for its smart contract functionality, is also popular due to its versatile applications beyond just digital currency.

Tether, a stablecoin pegged to the US dollar, is favored for its stability and is commonly used for trading and transactions. Despite the regulatory hurdles, these cryptocurrencies continue to be of interest to many in China, reflecting their global importance and appeal.

Bitcoin in China – Market Presence and Ownership Stats!

Bitcoin’s presence in the Chinese market has been significant over the years, with China being one of the largest markets for cryptocurrency trading and mining.

However, the Chinese government has imposed strict regulations and bans on Bitcoin trading and mining activities to maintain control over the financial system and prevent capital flight.

Despite these restrictions, Bitcoin remains popular among some investors and traders in China, who use various workarounds to continue their activities.

As for ownership, it’s estimated that a significant portion of the world’s Bitcoin holdings are in China, although precise figures are hard to determine due to the country’s crackdown on crypto activities.

Pros and Cons of China’s Cryptocurrency Policies!

Advantages:

- The digital yuan can make payments faster and easier, reducing the need for physical cash.

- Digital transactions can be more secure, with advanced technology helping to prevent fraud.

- The Chinese government can better oversee and control the financial system, which helps in monitoring economic activity.

- It can help in fighting financial crimes by tracking transactions more closely.

- It updates China’s payment system with modern technology, making it more efficient.

Disadvantages:

- Digital transactions can be monitored by the government, which may raise privacy issues for individuals.

- People need access to digital devices and the internet to use the digital yuan, which might be a problem for some.

- It centralizes financial control, which might reduce financial freedom for users.

- The government’s ability to track every transaction could lead to increased surveillance of citizens.

- Digital systems are vulnerable to hacking and cyber attacks, which could compromise security.

Learn About the Ruble’s Use, Top Currencies – How to Get It!

The ruble is primarily used in Russia, but it is also accepted in some neighboring countries like Belarus and parts of Ukraine and Kazakhstan due to close economic ties.

Among the world’s strongest currencies, the ruble is not as strong as currencies like the US dollar, euro, or Swiss franc. To acquire rubles, people usually need to exchange them at banks or currency exchange services. The ruble’s value can be influenced by Russia’s economic policies, international trade, and geopolitical factors.

Cryptocurrency Trends in Russia and BRICS Countries – Learn More!

Cryptocurrency adoption in Russia is growing, with the country showing interest in digital assets as an alternative to traditional financial systems. The Russian government has been cautious but supportive, introducing regulations to control and integrate cryptocurrencies into the economy.

Meanwhile, BRICS countries, which include Brazil, Russia, India, China, and South Africa, are exploring the creation of a joint cryptocurrency to strengthen economic ties and facilitate trade among themselves.

This BRICS cryptocurrency aims to enhance financial cooperation and reduce reliance on global currencies, offering a new way for these countries to conduct transactions within their group.

Frequently Ask Questions:

1. Why has China banned cryptocurrencies?

China banned cryptocurrencies to prevent financial risks, reduce speculative trading, and combat illegal financial activities. The government aims to protect its financial system and ensure economic stability.

2. What does the ban mean for cryptocurrency users in China?

Users in China can no longer trade or invest in cryptocurrencies legally. Exchanges and platforms dealing with crypto assets are also prohibited, affecting how people can buy or sell cryptocurrencies.

3. Are there any exceptions to the ban?

The ban generally applies to most cryptocurrency activities. However, the Chinese government continues to explore and develop its digital currency, the digital yuan, which is state-controlled and regulated.

4. How does the ban affect global cryptocurrency markets?

The ban may impact global cryptocurrency markets by reducing trading volumes and affecting investor sentiment. It can lead to increased volatility and shifts in market dynamics.

5. What alternatives do Chinese investors have now?

Chinese investors may turn to state-backed digital assets like the digital yuan or other investment options approved by the government. Traditional investments and assets are also available.

Conclusion:

China’s ban on cryptocurrencies aims to keep the financial system safe. This limits crypto trading but pushes for controlled digital money like the digital yuan. Stay updated and look for other investment choices as the situation develops.

Read more: